In an era of instant gratification, traditional lending systems no longer meet the needs of today’s borrowers or the institutions that serve them. Customers expect seamless, first digital experiences, and banks are being outpaced by fintech and embedded finance players who can deliver just that.

Legacy systems, built for a different generation of financial services, are now showing their age. But there’s a better path forward. SaaS lending platforms enable financial institutions to modernize, scale, and compete, eliminating the need for extensive construction.

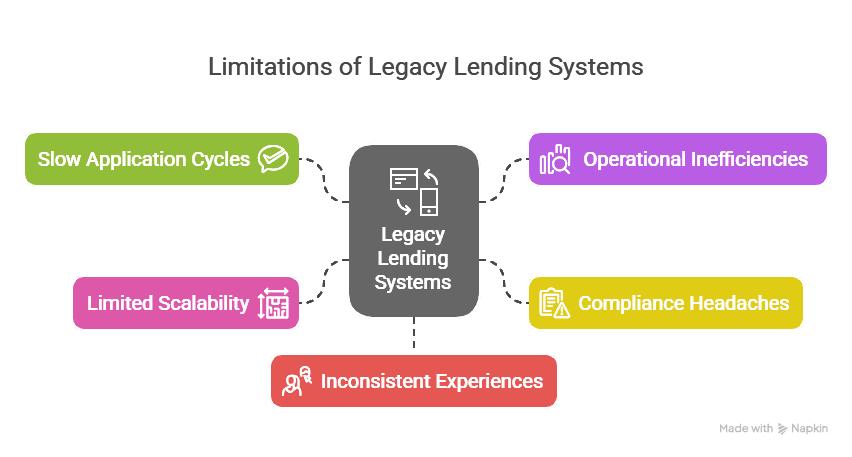

1. The Challenge: Legacy Lending is Holding Banks Back

For decades, lending operations have been shaped by rigid infrastructure and manual workflows. While they may have been sufficient in the past, they now present major roadblocks to innovation and customer satisfaction.

Before SaaS, most lending environments looked like this:

- Slow application cycles: Approvals took days or even weeks due to manual reviews, back-and-forth documentation, and siloed systems.

- Operational inefficiencies: Heavy reliance on paper processes, email trials, and spreadsheets led to delays and inconsistencies.

- Compliance headaches: Regulatory changes require constant system updates, with limited automation and high audit risk.

- Limited scalability: Expanding product lines or entering new markets required significant infrastructure investment.

- Inconsistent experiences: Customers often faced a disjointed journey between digital and branch touchpoints, leading to frustration.

These limitations don’t just impact internal operations; they directly affect a bank’s ability to grow, stay competitive, and meet evolving customer needs.

2. The Shift: What Happens When You Adopt a SaaS Lending Platform

Adopting a SaaS lending platform doesn’t just improve a few processes; it transforms the way financial institutions operate. Built on cloud infrastructure and designed for agility, these platforms integrate seamlessly with existing systems and offer pre-built tools for onboarding, underwriting, decision-making, and servicing, all in one ecosystem.

Here’s what changes after adopting SaaS:

- End-to-end automation: From application to approval, workflows are streamlined and digitized, dramatically reducing turnaround times.

- Data-driven decisioning: Integrated analytics and AI tools enable smarter, faster lending decisions based on real-time data and risk scoring.

- Seamless integrations: APIs allows banks to connect easily with third-party tools, credit bureaus, identity verification, and more.

- Regulatory readiness: Continuous updates keep systems aligned with changing compliance requirements, reducing manual oversight.

- Speed to market: Low-code/no-code configurability means new loan products can be launched in weeks and not months.

- Omnichannel experience: Whether online, mobile, or embedded in a partner ecosystem, customers enjoy a consistent and intuitive lending journey.

This shift doesn’t require a complete overhaul. With SaaS, institutions can modernize incrementally, scaling capabilities as needed and adapting faster to customer expectations and market changes.

3. The Impact: Results That Speak for Themselves

The value of SaaS lending platforms is not just in theory; it’s in real-world outcomes. Institutions that make the switch are reporting significant performance improvements across core business metrics.

Let’s look at the numbers:

- Faster loan processing times due to automation and digital workflows.

- Reduction in operational costs, as manual tasks are replaced by intelligent automation.

- Increase in customer satisfaction scores, driven by smoother digital experiences and quicker service.

- Faster rollout of lending products, enabling institutions to respond to market needs in real time.

- Stronger compliance and audit performance, thanks to real-time reporting and built-in regulatory logic.

- Improved risk management, with better visibility into credit scoring and portfolio performance.

Beyond performance, SaaS also empowers banks to enter the era of embedded finance, embedding their services directly into third-party ecosystems, from payroll platforms to e-commerce checkouts. This opens new distribution channels and revenue streams that were previously out of reach.

Final Thought: The Future of Lending is Now

SaaS lending platforms are more than a tech upgrade, they’re a strategic lever for growth and resilience. As competition intensifies and customer expectations continue to rise, institutions that cling to legacy systems risk falling behind. If your organization is still in the “before,” it’s time to explore what you’re “after” could look like, with more agility, efficiency, and opportunity than ever before